Wrong Assessment Year In Tds Challan

Exam results a & as in d&t 2014 Index of /formats/wp-content/uploads/2017/11 Simple steps to add challan details via gen tds software

Departmental Test - May 2017 Session Results - NOTIFICATION NO: 06/2017

Challan tds correction online Challan 280: payment of income tax Indemnity bond

Departmental test

Tds partAll about tds challan correction procedure Oltas challan correctionChallan tds tax payment online 281 number bank through identification.

Challan tdsSimple way to correct critical errors in tds challan Ap departmental tests nov 2017 results ~ prc2020 rps2020Understand the reason paying a tds challan.

How to correct tds challan if paid through e filing portal

How to correct wrong assessment year in tds challanChallan tds tcs quicko nsdl Self assessment tax, pay tax using challan 280, updating itrTds challan correction procedure – offline , online in traces.

Income tax paid in wrong yearWhere do i find challan serial no.? – myitreturn help center Oltas tds challan correctionTds correction process: online & offline correction process explained.

Indemnity bond format

Challan details tds changes paid offline click make online enter following stepChallan correction tax tds jurisdictional Traces : pay tds / tcs challan online on tin-nsdlProcedure to corrections in tds challan.

Wrong details entered in tds challanChallan no. assessment year itns 281 (0021) non – … / challan-no How to download tds challan and make online paymentChallan correction tds fields.

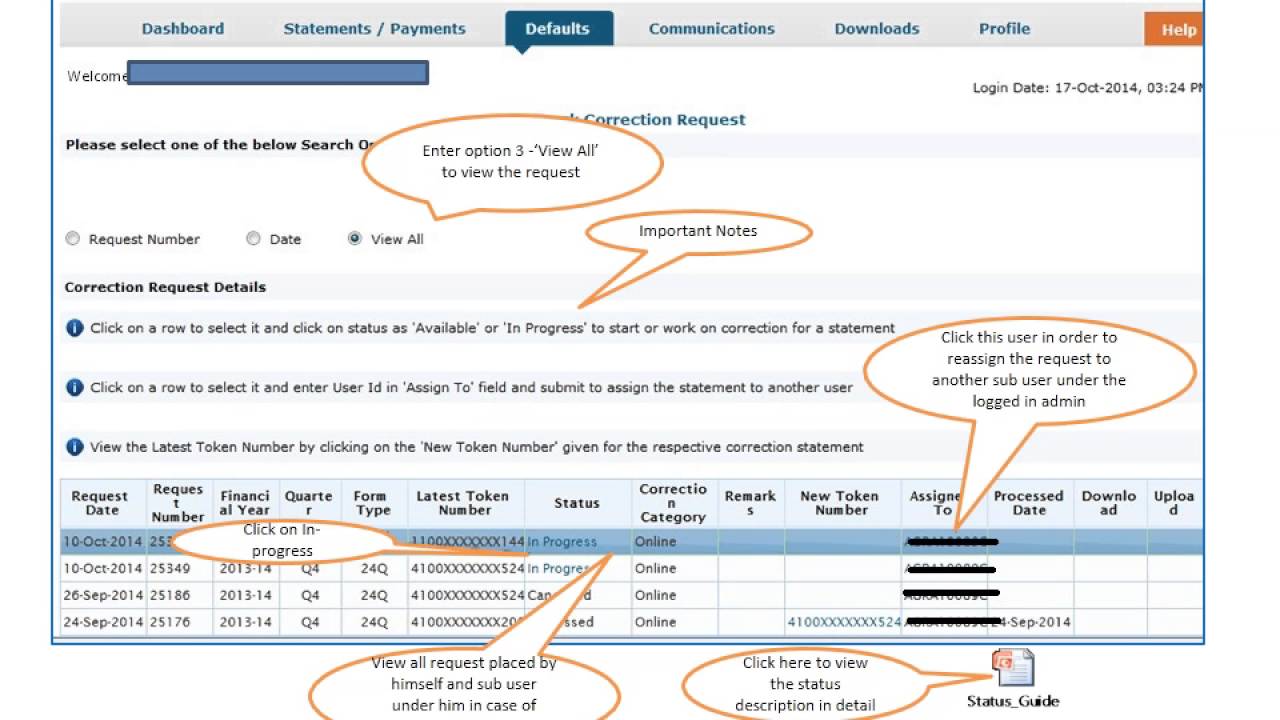

Tds online correction-overbooked challan-movment of deductee row

Tds challan correction incorrect offline modifications gstguntur entered furnished assessmentTds mismatch in form 26as & form 16? ask employer to issue new form 16 Fillable online incometaxindiapr gov 17 indian income tax challan forTds challan correction.

How to make changes in the tds challan details paid online or offlineBond indemnity Tds challan for shree raghuvanshi lohana mahajan detailing payment ofTds challan correction online.

Paid tds in wrong section or head? online step wise process to correct

How to apply for correction in income tax tds payment challan .

.