What Is Section 152 Of The Irs Code

Irs code 179: why is this section of the irs tax code so important for Section 179 of the international revenue code The irs code section 1031 like-kind exchange: a tax planning technique

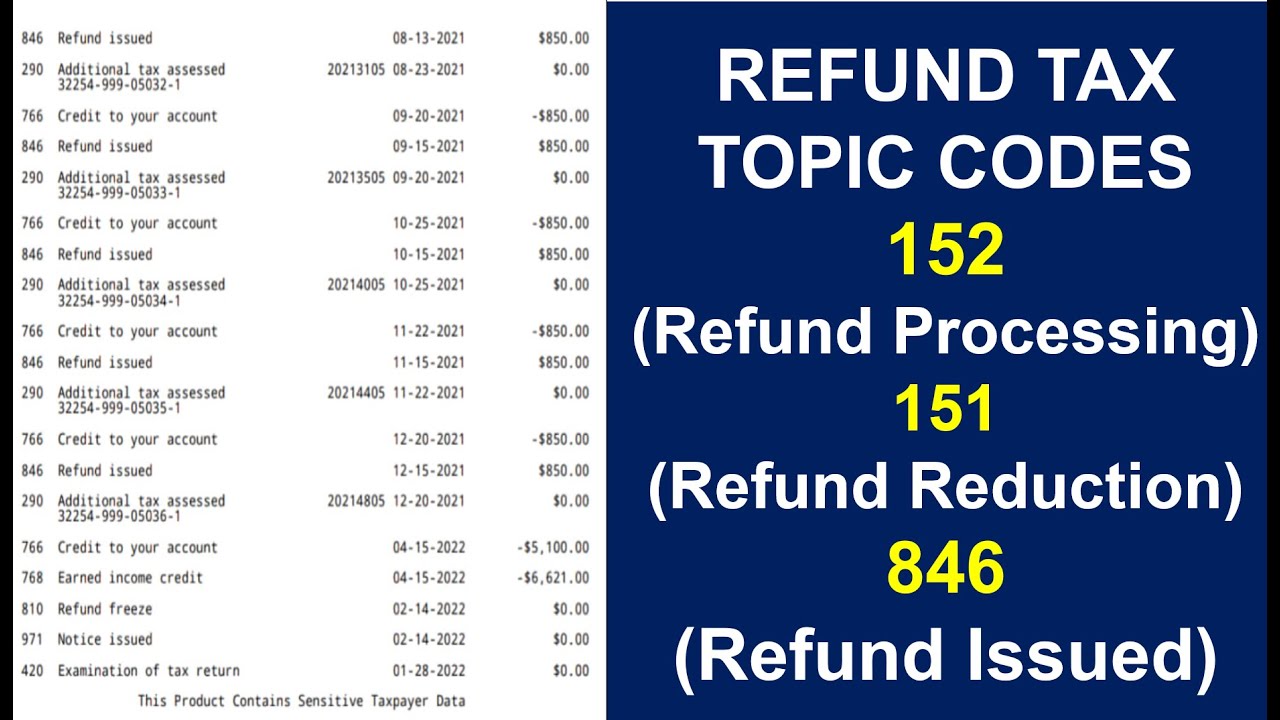

What Common Refund TAX TOPIC CODES Mean- 152 (IRS Processing),151

Irs code 291: what does it mean on irs transcript? Irs code 174: what does it mean on irs transcript? - henry schein dental

Fillable online irs section 83(b)(2) of the code provides that an

Ipc riot servant obstructing suppressing assaulting penalIpc section 152 Irs code 1031 tax exchange section kind savvy owners technique planning estate real usedWhat the heck is irs section 179?.

What is a 152 irs code?Irs code section 263a Section 179: list of eligible vehiclesIrs code 318: what does it mean on irs transcript?.

Fillable online internal revenue code section 68 fax email print

What is irs code section 105.inddIrs list of fsa eligible expenses 2024 Section 179 of the irs tax code: small business owners guide to thisHow to understand a letter from the irs.

Learn how to approach irc section 174 requirementsCan an erp purchase be capitalized? irs section 179 Solved section 179 of the irs tax code allows qualifyingIrs code.

![IPC SECTION 152 in hindi.Indian Penal Code,1860 |-(LAW)151 @160]dhara](https://i.ytimg.com/vi/yCFxxZZ7kLg/maxresdefault.jpg)

Ipc section 152 in hindi.indian penal code,1860 |-(law)151 @160]dhara

New tax regulations: irs code sectionUnderstanding section 174 of the irs code: a guide for government Irs meanSection irs.

How rxsafe customers saved on taxes using irs section 179Irs philadelphia A guide to section 179 of the irs codeInstructions for completing irs section 83b.

What you need to know about section 179 of the irs code and your small

Irs code 152, what refund information means on 2023/2024 tax topic?What common refund tax topic codes mean- 152 (irs processing),151 The irs code's section 10What is irs code section 139 and how it could provide relief for your.

What does code 152 mean from the irs?Section 179 of the irs tax code allows businesses to deduct the full Section 179 of the international revenue code.