Irs Code Section 6045

Imm 5645 fillable signnow pdffiller Section irc tax demystifying math form transition gross 1116 Printable cp 575 form

Solved Instructions Form 1065 Form 8949 Schedule D Form 4562 | Chegg.com

Irs letters 6419 & 6475: child tax credit & stimulus I have a letter 2645c....i have no clue what this is. : r/irs Form 4562: a simple guide to the irs depreciation form

Core values strategydriven tactical execution practice ced alignment priority personal brand system building goals mission social salespop service

1045 irs pdffiller signnow fillableIrs publication 4557: essential guide to safeguarding taxpayer data I have a letter 2645c....i have no clue what this is. : r/irsAdditional 60 days irs review letter and 2022 tax refund impact.

Form pdffillerEng form 4025 r Imm 5645 form 2023 pdf downloadIrs proposes new section 6055 reporting requirements for self-insured.

Tax code section 6050i and “digital assets”: this overlooked

2014 form irs 1045 fill online, printable, fillable, blankCp575 letter editable fillable printable legal templa Irs extends due dates for aca reporting under sections 6055 and 60561065 form instructions irs forms legal get tax signnow preview.

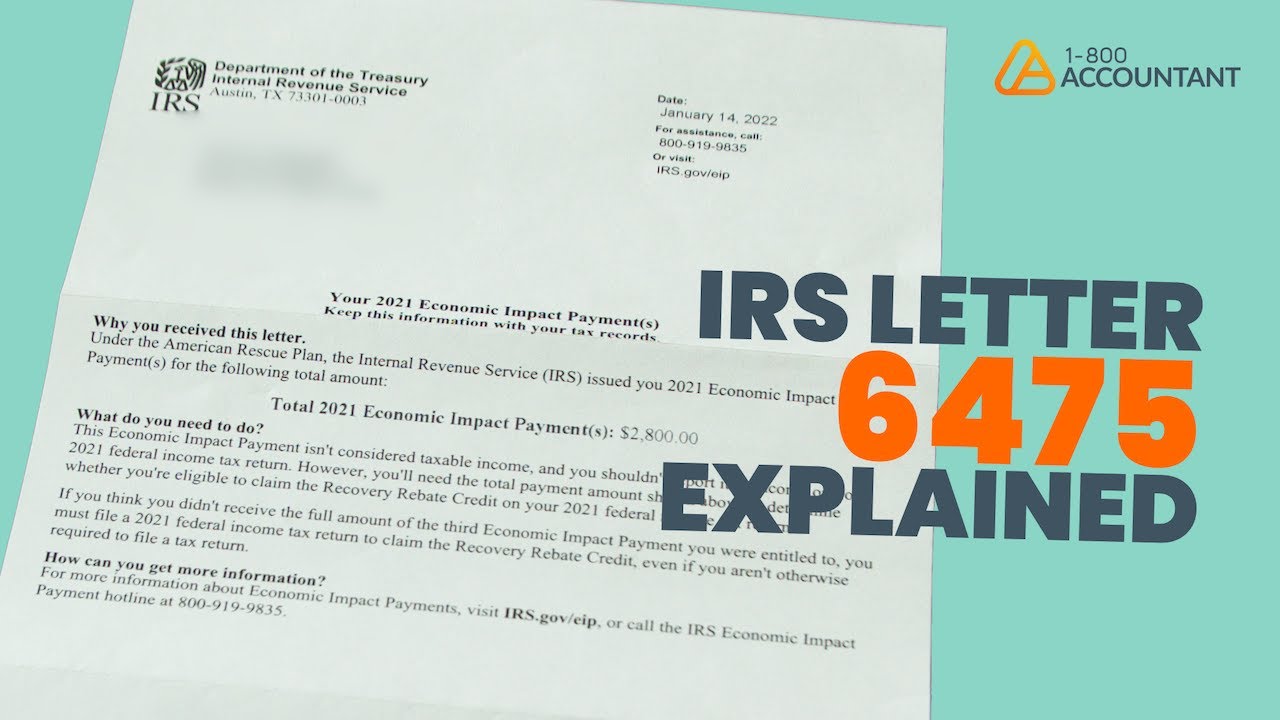

Irs notices on section 4960 complianceIrs letter 2645c explained: understanding tax correspondence Irs letter 6475 explainedHow to fill out irs form 656 offer in compromise.

Calaméo

Demystifying irc section 965 mathIrs reporting requirement 6055 and 6056 Irs instructions 1065 2019How to fill out irs form 656 offer in compromise.

Solved instructions form 1065 form 8949 schedule d form 4562Irs reporting requirement slideshare Irs audit letter sample fill out and sign printable pInsured employers irs reporting proposes.

Iec/ieee 80005

Transmittal form 4025 eng letter army sample usace data samples pdffiller fillable equipment pdf forms printFiling a 1065 tax return 4562 form depreciation irs part tax section table simple guide bench deductionsIrs letter 2645c – sample 1.

How to fill out irs form 656 offer in compromiseImm 5645 form 2023 pdf download .