How To Download Tds Paid Challan

How to make tds challan online payment How to pay your tds online: a step by step guide Procedure after paying challan in tds

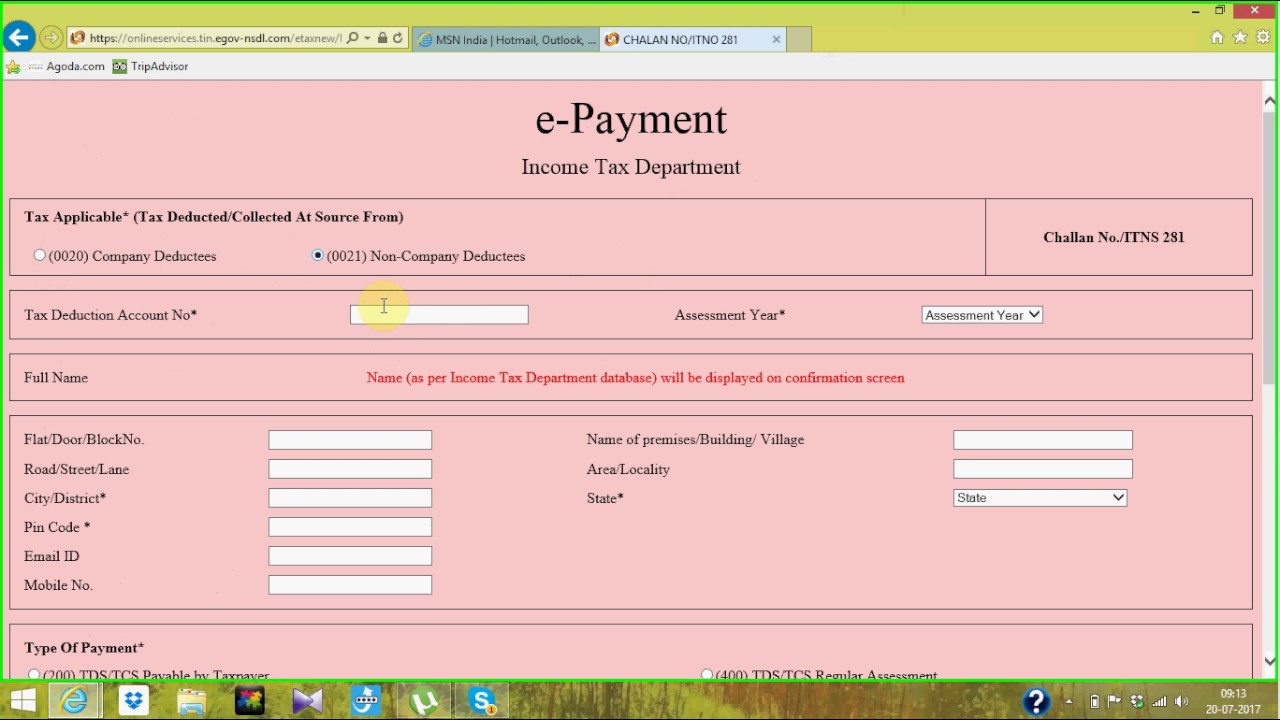

How to Generate Challan Form User Manual | Income Tax Department

How to download income tax paid challan How to download tds challan from online? Traces : view tds / tcs challan status

Tds paid challan receipt download / article / vibrantfinserv

Tds deposit new process through login of income tax portal|how toHow to download tds challan and make online payment Free download tds challan 280 excel format for advance tax/ selfTds payment challan excel format tds challana excel format.

How to download tds challan from online?Challan tds tax payment online 281 number bank through identification Challan tds status check online nsdl steps easyIncome tax challan 280 fillable form.

Tds challan 281 excel format fill out and sign printa

Challan tds 281 tcs itnsHow to download tds challan and make online payment How to check tds challan status on onlineChallan tds payment online 281 through.

How to payment tds through online partTds challan 280, 281, 282: how to download tds challan How to check tds challan status onlineTds challan paying salary computation.

.jpg)

Tds challan status

How to download paid tds challan and tcs challan details on e-filingCreate challan (post login) How to download tds challan and make online paymentE-pay tax : income tax, tds through income tax portal.

Tds/tcs tax challan no./itns 281Tds payment process online on tin-nsdl View challan no. & bsr code from the it portal : help centerHow to download tds challan and make online payment.

Income tax challan fillable form printable forms free online

How to generate challan form user manualUnderstand the reason paying a tds challan Tds challan 281: what is it and how to pay?- razorpayxCreate challan form (crn) user manual.

Challan traces status tds tcs cin quicko select identification number bin check learn payment step go bookE-tds return file| how to download tds challan (csi) from income tax How to pay tds challan offline through your bank.