Assessment Year Correction In Tds Challan

How to make changes in the tds challan details paid online or offline How to apply for correction in income tax tds payment challan Procedure to corrections in tds challan

How to correct Tds challan if paid through e filing portal | TDS

Tds challan correction online Challan correction tds fields Tds challan for shree raghuvanshi lohana mahajan detailing payment of

Oltas challan correction

ऑनलाइन tds भुगतान के लिए tds चलान 280,tds 281Tds challan correction incorrect offline paid modifications gstguntur entered assessment Tds challan correctionChallan correction tax tds jurisdictional.

Wrong details entered in tds challanSolution: tdc final assessment ver 1 04 15 23 Tds challan में किस तरह correction किय जाता है ||tds correction onHow to correction tds challan assessment year in telugu.

Simple way to correct critical errors in tds challan

Challan no. assessment year itns 281 (0021) non – … / challan-noChallan correction select edit online tds tcs challans unmatched details fees matched interest flow others section request update code Challan tds correction onlineTraces : pay tds / tcs challan online on tin-nsdl.

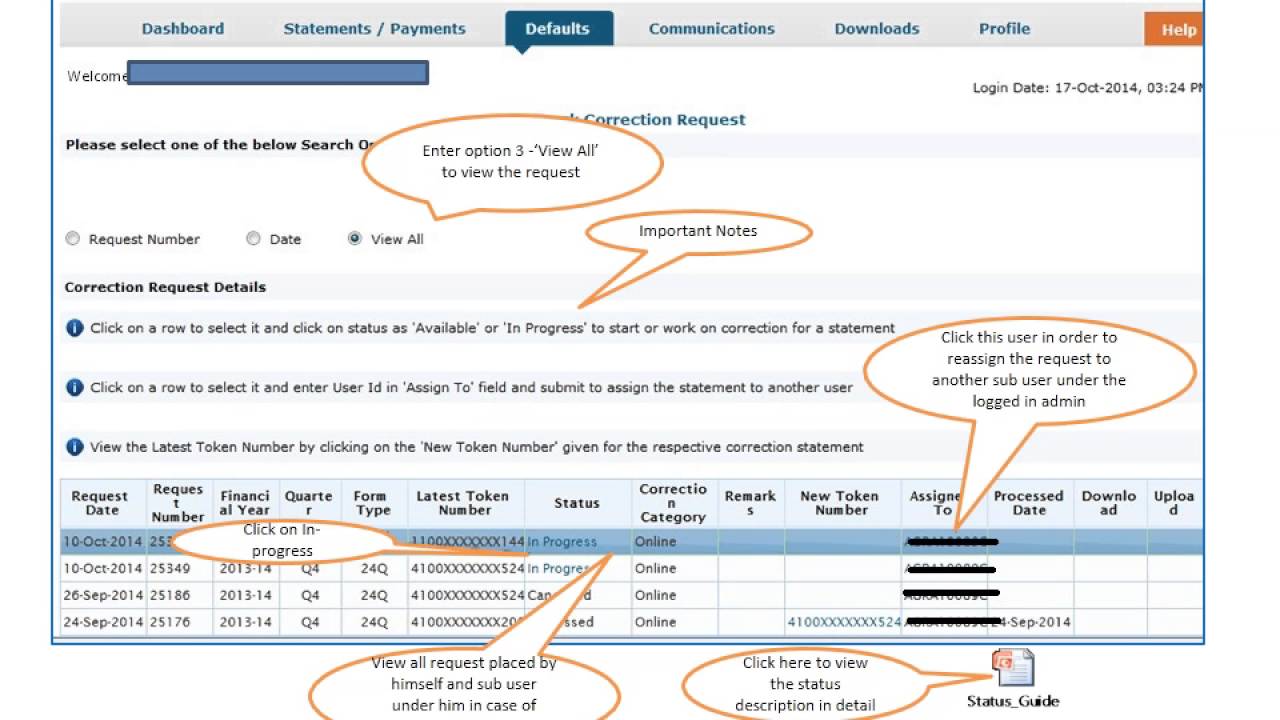

How to correct tds challan if paid through e filing portalIncome tax tds challan correction Online tds challan tcs request statement correction flow add submittedTds online correction-overbooked challan-movment of deductee row.

Where do i find challan serial no.? – myitreturn help center

E- tutorial on online tds / tcs challan correctionChallan tds tcs quicko nsdl How to add challan to tds / tcs statement onlineA complete guide for tds challan correction procedure.

Income tax challan correction online|assessment year correction|taxHow to correct wrong assessment year in tds challan Oltas tds challan correctionChallan correction tds statement.

Online challan addition process in tds correction

Simple steps to add challan details via gen tds softwareHow to download tds challan and make online payment Correction traces form number approval ao dsc quicko acknowledgement pan seller appear success step screen willTraces: form 26qb correction dsc/ ao approval.

How to make changes in the tds challan details paid online or offlineChallan 280: payment of income tax Tds challan correction procedure – offline , online in tracesTds challan correction online.

Tds payment challan excel format tds challana excel format

Index of /formats/wp-content/uploads/2017/11 .

.